Prove Your Potential. Profit Like A Pro.

How many truly successful traders do you know who started from scratch? How many do you know who started with significant amounts of capital?

It’s not a coincidence that you’ve probably heard of more traders from the second category. Having capital to trade with isn’t just advantageous. It’s essential.

If you’ve always wanted the chance to trade like a professional, sever your emotional connection to market fluctuations and take fear and greed out of the equation…

We Fund You Trade gives you the opportunity to reach your trading potential.

What We’re Looking For…

What We Can Offer You…

Get funded through our simple two step challenge and gain access to an account up to $200K

Step One

Step One

Step Two

Step Two

Make 5% Profit with 5 Minimum Trading Days.

Customer Reviews

A few words from our traders

Find out what our traders have to say about We Fund Your Trade.

Frequently Asked Questions

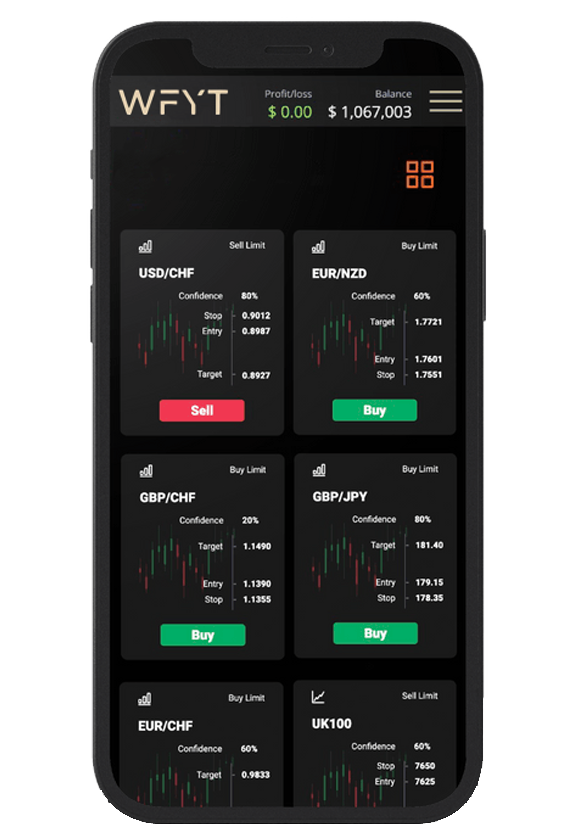

You can utilise our trader dashboard, which offers a comprehensive analytics suite and tracks your trading account and all trades placed.

In Step 1 and Step 2 , you’re required to trade for at least 5 days. If you’ve fulfilled these minimum trading days and achieved your profit targets without violating any rules, you are eligible to pass your phase early.

Absolutely. If all required trading objectives are met within the specified time frame without any rule violation, the trader successfully passes the evaluation phase and transitions to a live funded account.

Trades must be held for at least three minutes.

Yes, traders can manage multiple funded accounts, subject to an overall funding limit of $600,000. However, each account per audition tier must be unique. For example, if you’re managing a $100,000 account and wish to trade with a higher amount, you can apply for an additional $50,000 account by taking a $50,000 WFYT Audition.

No, WFYT is a proprietary trading firm. We do not accept deposits from traders for trading their own funds. As a trader, you don’t put your capital at risk and aren’t liable for losses incurred on live funded accounts.

At WFYT, we offer a wide array of payment methods, accepting all major credit and debit cards as well as direct wire transfers.

For the first three payouts of the live funded account, we offer an 80% share of profits made on the funded account. From the fourth payment onwards, the profit share is increased to 85%.

At WFYT, we’ve negotiated favourable spreads with our broker, Capital Index. Importantly, there are no data fees, trading commissions, or slippage costs on trade execution. We aim to provide a transparent and cost-effective trading environment.

At WFYT, we value your success and demonstrate this by refunding your challenge fees. This refund is processed once you make your first profit withdrawal from your live funded account.

The fee charged for the WFYT Audition is in place for several reasons. Primarily, it helps cover our operational expenses, including technological platforms, personnel, customer service, marketing, and other crucial costs that contribute to a robust company. Furthermore, the fee ensures traders are committed to disciplined trading practices. The “skin in the game” concept encourages traders to manage their account responsibly. Notably, the audition fee is the only capital at risk for traders, as losses on live funded accounts are covered by WFYT. This fee also filters out and attracts only serious, profit-generating traders, fostering a strong WFYT community. Ultimately, we believe that the WFYT programme offers valuable service and the fee supports a beneficial, symbiotic relationship.

Initial Equity and Drawdown Limit: Starting with an equity of 100k, a trader has a daily drawdown limit of 5%. This implies they can’t let their equity drop below 95k on that day without breaching their challenge.

Profitable Day without Rollover: If, during the same trading day, a trader’s equity rises to 103k before rollover occurs, the daily drawdown limit remains anchored to the initial equity, meaning it’s still at 95k.

Profitable Day after Rollover: If a trader closes the day with an equity of 103k and the rollover takes place, the daily drawdown for the next trading day is recalculated based on this new equity value. Thus, 5% of 103k is 5150. For the next day, their equity shouldn’t go below $97,850.

Losing Scenario: Similarly, if the equity drops, the daily drawdown will be adjusted based on the closing equity of the day after the rollover.

Dashboard Update: Traders can keep track of their daily drawdown limits, which are continuously updated in the dashboard under the “performance” tab.

The responsibility for meeting all relevant tax obligations in your country or region lies with you. It’s essential to keep track of and comply with your local tax laws regarding trading profits.

Yes, you can hold your trades open overnight and over the weekend. However, be aware that leverage may vary during periods of heightened market volatility.

Copy Trading is not permitted during the evaluation stage if the intention is to pass the evaluation by mirroring another’s trades, whether from your evaluation accounts or from others. Traders found engaging in such practices may face review and potential breach of agreement, leading to the loss of the funded account.